My office is working on solutions to alleviate the home insurance crisis affecting Puna residents, especially in lava zones 1 and 2. We want to ensure everyone can access affordable and reliable insurance coverage, regardless of where they live.

We are considering several potential solutions. One is to seek a state subsidy for Hawaii Property Insurance Association (HPIA), which could help make premiums more affordable. However, this would require legislative approval and could face challenges due to the relatively small population of lava zones 1 and 2.

Another potential solution is to establish a robust consumer alert system. This system would notify policyholders when their insurance provider plans to leave, giving them ample time to seek alternatives.

We are also considering the development of detailed lava flow models. These models could help insurance providers better understand and assess the risks associated with coverage in these zones, encouraging more providers to offer insurance coverage.

Lastly, we are exploring payment plan options for HPIA policyholders. Installment plans could make premiums more manageable but require a significant update to HPIA’s current insurance systems.

In addition to the above solutions, we urge the Hawaii Federal Delegation to support amending the National Flood Insurance Program to include policies covering lava incidents. This option could provide a more affordable alternative in the insurance market and expand the range of choices available to our residents.

Background

Universal Property and Casualty Insurance Co., one of our primary insurance providers, has withdrawn its services from Hawaii. This decision affects approximately 1,500 insurance policies across our state, which non-renew a few hundred insurance policies per month, terminating by August 31, 2024. It is particularly significant for Puna because 1,000 insurance policies are on the Big Island, mainly on Lava Zones 1 and 2.

This situation is particularly challenging for our Puna residents in Lava Zones 1 and 2. The withdrawal of Universal Property and Casualty Insurance Co. leaves them with limited options for securing property insurance. The only remaining provider is the Hawaii Property Insurance Association (HPIA), which offers basic property insurance for those who can’t obtain conventional private coverage. However, the premiums for HPIA are significantly expensive, making it difficult for many of our residents to afford.

House District 4 Bills Package

Frequently Asked Questions

- What is the Hawaii Property Insurance Association (HPIA)?: The HPIA is a nonprofit insurance carrier established by the Hawaii Legislature in 1991. It was created to provide property insurance to residents living in Lava Zones 1 and 2 who were unable to secure insurance on the private market.

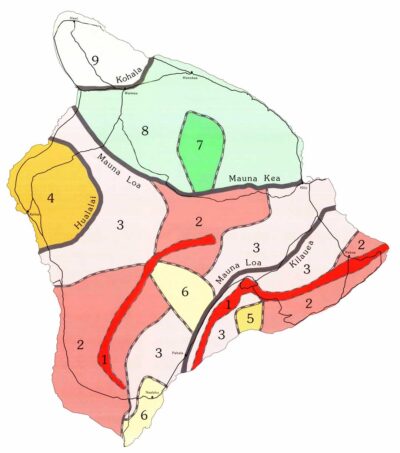

- What are Lava Zones?: There are 9 lava zones for the five volcanoes (Kīlauea, Mauna Loa, Mauna Kea, Hualālai, and Kohala) on the Big Island. The US Geological Survey (USGS) ranks these zones from 1 through 9, representing a scale of decreasing hazard as the numbers increase, based on the probability of coverage by lava flows.

- How are Lava Zones determined?: The hazard zones are based on the locations of probable eruption sites, past eruption sites, paths of lava flows, and the frequency of lava flow inundation of an area over the past several thousand years. The boundaries of these zones are gradual, and the hazard decreases as you move further from an eruptive vent.

- What is the purpose of Lava Flow Maps?: The lava flow maps were developed for general planning purposes and designed to show the relative hazard across Hawaii Island. They are intended to convey volcanic hazard rather than risk.

- How does the HPIA operate?: Private insurance companies wishing to do business in Hawaii must join the HPIA. These companies contribute to a shared pool that covers the expenses, losses, and profits of the association in proportion to their market share of casualty and property insurance in the state.

- What financial challenges is the HPIA currently facing?: The HPIA is currently dealing with financial difficulties due to the 2018 Lava Flow in Puna, which resulted in 152 insurance claims and a total loss of $35 million.

- How have these challenges affected insurance premiums?: Due to these losses, the HPIA has had to increase insurance premiums.

- Who oversees the HPIA?: The HPIA is governed by a 12-member board of directors, which includes eight representatives from insurance companies, one representative from insurance agents, and three representatives from the public.

- What insurance coverage does the HPIA currently offer?: Currently, the HPIA does not offer hurricane insurance, and there is no specific lava policy insurance.

- How much does HPIA insurance cost?: The cost to insure a property with the HPIA depends on the coverage limits chosen by the homeowner. For example, if a homeowner decides to insure their dwelling, personal property, and potential loss of use, the total insurable value could be up to $450,000.

- What areas does the HPIA cover?: The HPIA provides insurance coverage throughout Hawaii, including homes that may not meet the standard criteria for private market insurance, such as older homes not maintained or houses built on the shoreline.

- What are the insurance rates for homes in Lava Zones 1 and 2?: For homes in lava zones one and two, the insurance rates with HPIA are significantly higher than those of Universal Property and Casualty Insurance Co., with the average insurance rate with HPIA being around $4,000.

- What is the impact of Universal Property and Casualty Insurance Co.’s withdrawal?: Universal Property and Casualty Insurance Co.’s withdrawal from Hawaii will affect approximately 1,500 insurance policies across our state, non-renewing a few hundred insurance policies per month, with all terminations expected by August 31, 2024.

- How will this withdrawal impact Puna?: This withdrawal is particularly significant for Puna because 1,000 of the affected insurance policies are on the Big Island, mainly in Lava Zones 1 and 2.

- What are the options for homeowners affected by Universal Property & Casualty’s exit?: The Hawai‘i Insurance Division encourages homeowners to talk to their agent to identify insurance coverage options in their area. If homeowners are unable to obtain Homeowners or Dwelling Fire coverage from a private insurance company, they may qualify for coverage from the Hawaii Property Insurance Association (HPIA).